Is UK insurance sector oversold?

So here we are roughly two months into the market turmoil caused (or better said - used as a precursor) by coronovirus outbreak and financial sector again prove to be the most affected (like in 2008 recession). Of course there is a good reason for this despite the fact that this time around it is not banks's fault and their capital position is substantially better. The reason is that all the difficulties ordinary businesses and individuals are having now and will likely have for many months to come will eventually manifest themselves in their ability to pay off debt. A lot of debt. Mortgages, personal loans, business loans - you name it, lots of it will have to be restructured. Early indications are the provisions created by banks for bad loans in the US (revenue reporting season has already started there).

But what about insurers? Are they affected as severely as banks? There are arguments that this is not the case. They may also have to provide payment holidays like banks, but are not as leveraged as banks. And if the customer can't or not willing to pay for their insurance policy just get cancelled. Investors are probably more worried about the following:

- Erosion of returns on investments as we're closer to zero or even negative rates than we've ever been before.

- Potential payouts on health and business continuity policies.

The first issue is pretty chronic now and very familiar to insurance companies in eurozone where investment-grade debt trades with yields below zero since last year, but what the second one? Are we to expect an avalanche of claims on business continuity policies?

In our view this is unlikely. Besides specific pandemic insurance policies that certainly exist and are priced appropriately, regular policies usually exclude pandemic events. This makes perfect sense because unlike typical events like fires and thefts, pandemic affects all insured customers at the same time. Insurance business is based on underwriting risks that only materialise for a very few customers at the same time.

Not only are mass claims under business interruption policies unlikely, but we may see an improved payout ratio down the road after the quarantine is lifted. The longer lock-out period is in force, fewer events happen under many other policies. Take for example motor policies. With people not driving every day to work there will definitely be much fewer car accidents and hence claims under motor policies. As long as the restrictions don't last too long people will be unlikely to cancel the car policies.

Aviva now is almost 40% below the level on 20th of March

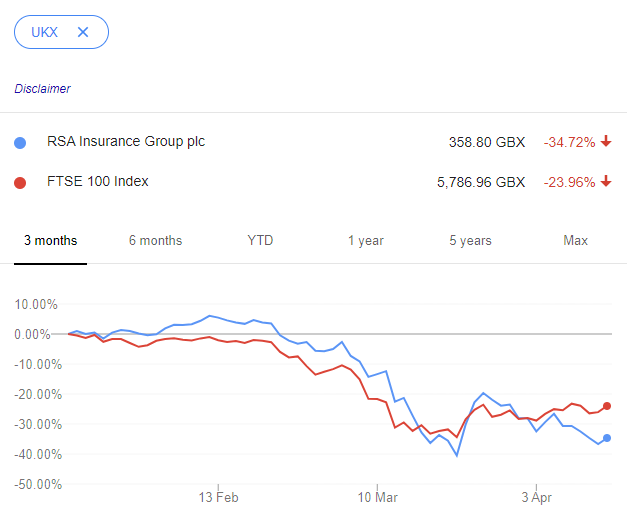

Aviva and RSA, UK's largest general insurers, underperformed wider FTSE 100 index by as much as 50% since the market fallout in late February. Final dividend cancellation that happened on the same day 8th of April didn't help share price, though can't be the reason of relative weakness given that by 19th of April more than a third of FTSE 100 companies cancelled or at the very least postponed their dividends.

Investors should also be aware of the uniqueness of the situation the world is in right now. With governments around the world plunging into debt at accelerated speed, there will be a desire to find and force business to carry their 'fair' share of burden that far exceeds normal taxation. The deeper the pockets of an industry, the more likely it is to become the target. Loosely drafted insurance policies led Lloyds of London to a bankruptcy in 1980s, but not without an epic court decisions. Could we see something similar these days? Perhaps, but not necessarily everywhere. This will be a function of a level of public debt, time to the next general elections and likelihood of left leaning political forces winning them.